2024 Schedule A 2024 Charitable Contributions – because you only use Schedule A when the total of your itemized expenses exceeds the standard deduction. One way around that problem is to bunch several years of planned charitable contributions . qualified charitable distributions, or QCDs. For 2024, these givers can contribute IRA funds totaling $105,000 directly to one or more charities. These donations aren’t deductible on Schedule A .

2024 Schedule A 2024 Charitable Contributions

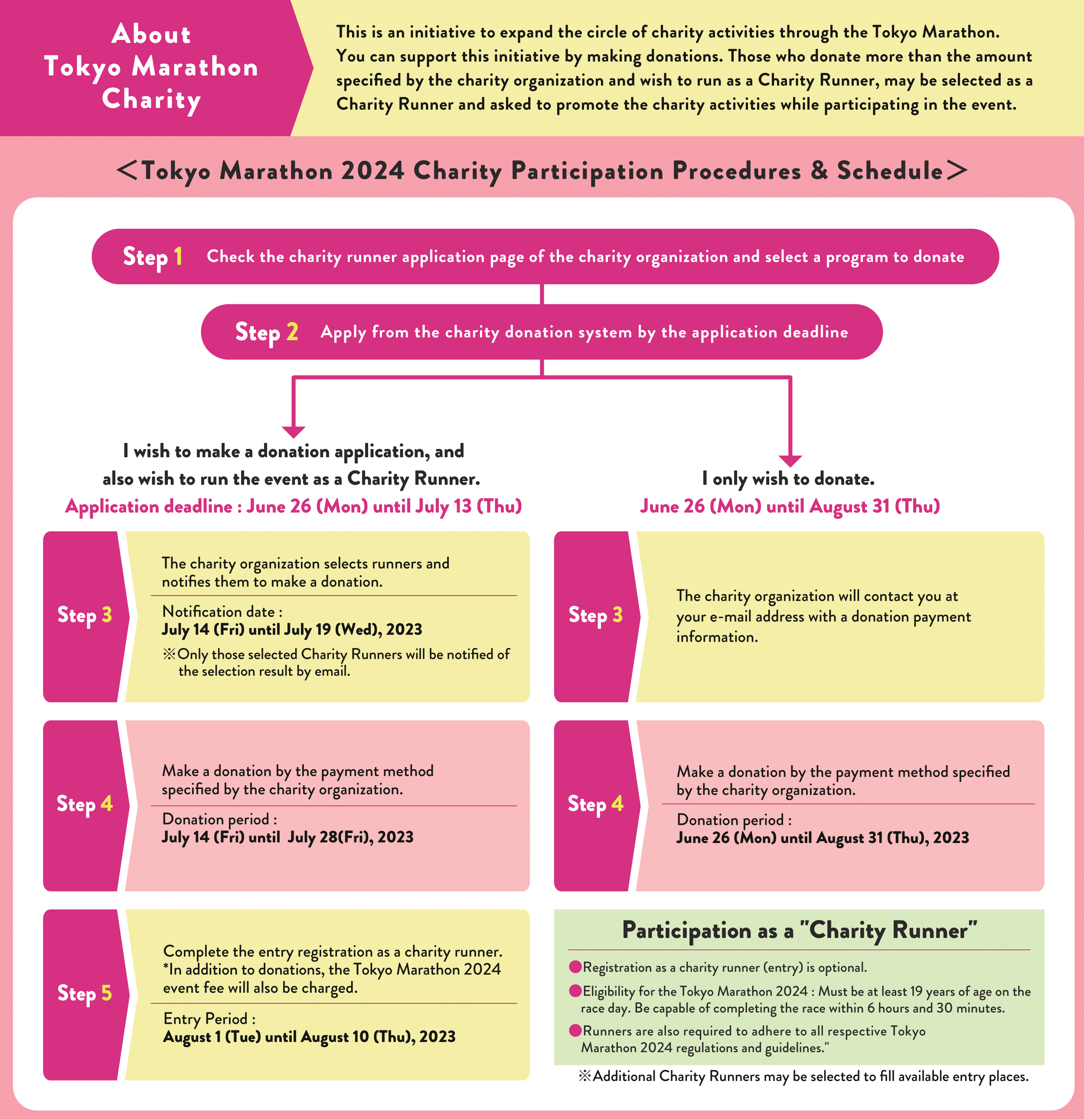

Source : store.churchlawandtax.comCharity | TOKYO MARATHON 2024

Source : www.marathon.tokyoMoolah Shrine Circus – The Family Arena

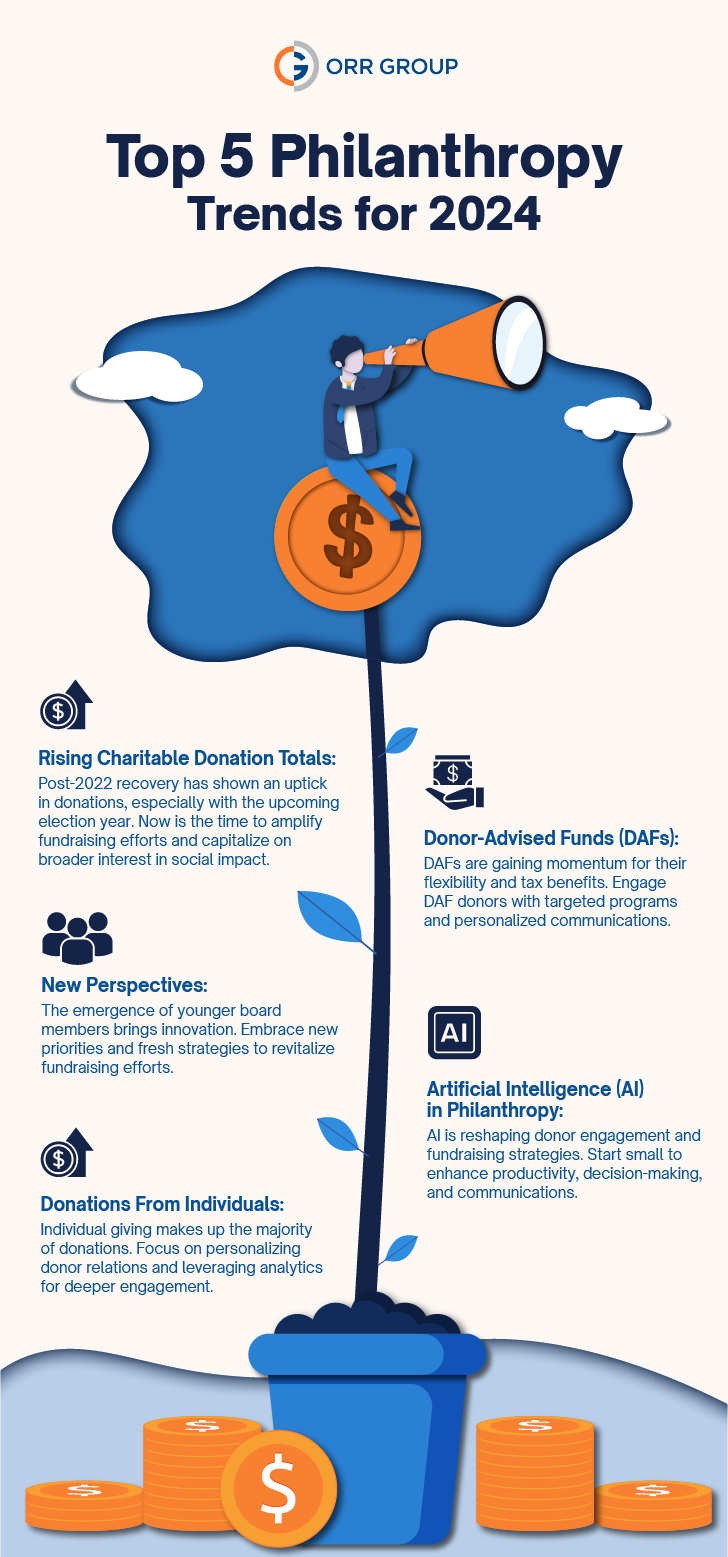

Source : familyarena.comPhilanthropy In 2024 And Beyond: Trends, Transitions, And

Source : orrgroup.comFresh Start: Tips for Charitable Giving in 2024 The Community

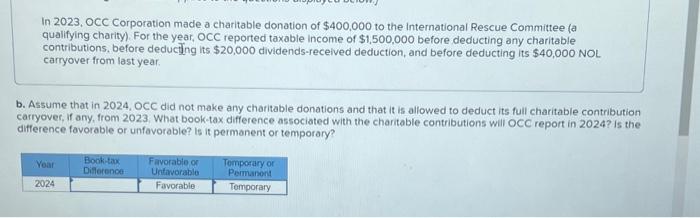

Source : www.frederickcountygives.orgSolved In 2023, OCC Corporation made a charitable donation | Chegg.com

Source : www.chegg.comPhilanthropic Insights | January 2024

Source : www.linkedin.comConquer Cancer, the ASCO Foundation on X: “It’s the best time of

Source : twitter.comNH Business Review 2024 Charitable Giving Guide now available NH

Source : www.nhcf.orgClean slate: Tips for charitable giving in 2024 by FM Area

Source : issuu.com2024 Schedule A 2024 Charitable Contributions 2024 Church & Clergy Tax Guide (Book): The deadline for filing taxes this year is Apr. 15, 2024. As this deadline approaches itemizing deductions such as mortgage interest and charitable donations, taking advantage of education credits . But 2024 starts a new era for the event that moved to Palm Beach County two decades ago. With American Honda ending its 42-year association with the tournament, it’s been rebranded as the Cognizant .

]]>