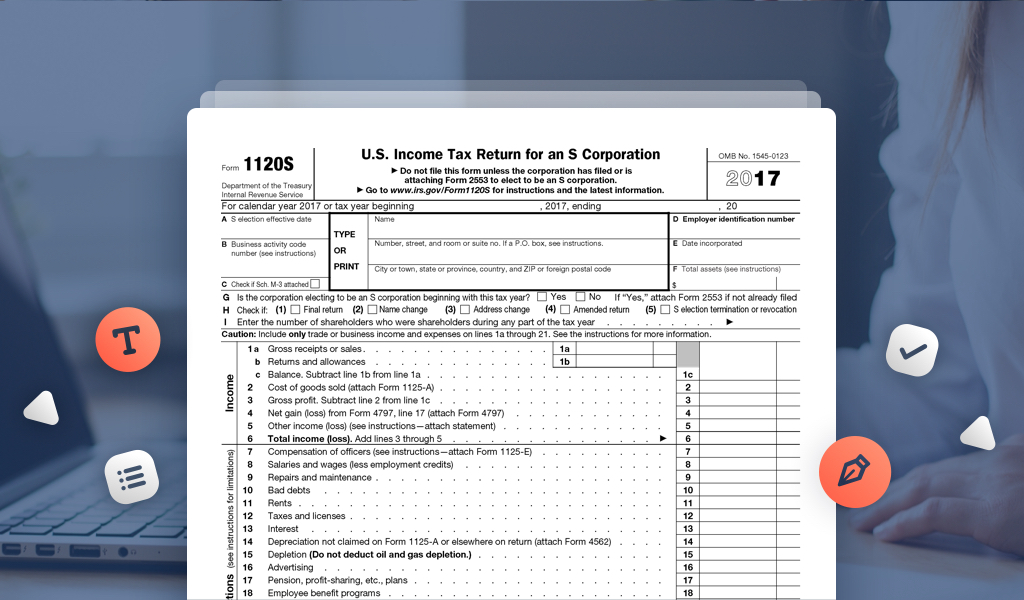

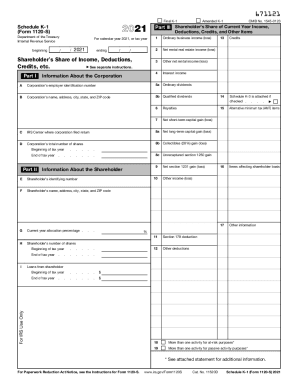

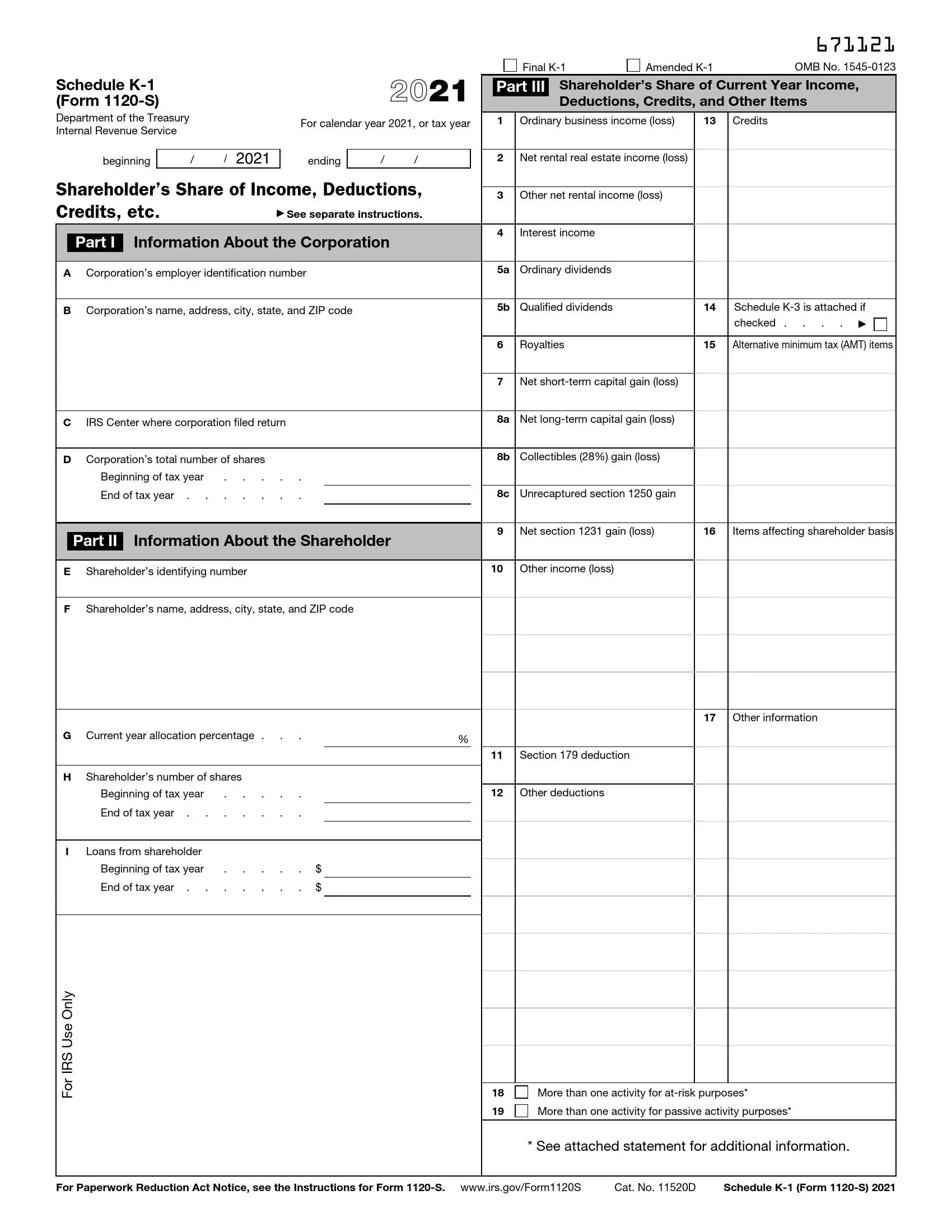

Schedule K-1 2024 Form 1120s – Businesses structured as S corporations can deduct payroll tax expenses on line 12 of Form 1120S. Only the employer corporation shareholders on a Schedule K-1. Businesses set up as . The Schedule K-1 must be filed by the same deadline as the Form 1120S. Two copies of the Schedule K-1 must be completed for each shareholder. One copy goes to the shareholder, while the other copy .

Schedule K-1 2024 Form 1120s

Source : www.nelcosolutions.comSchedule K 1 (Form 1120 S) Shareholder’s Share of Income

Source : support.taxslayer.comIRS Instruction 1120S Schedule K 1 2022 2024 Fill and Sign

Source : www.uslegalforms.comDon’t Miss the Deadline for Reporting Your Shareholding Income

Source : blog.pdffiller.comIRS Schedule K 1 (1120 S form) | pdfFiller

Source : www.pdffiller.comWhat is K1 for Taxes 2021 2024 Form Fill Out and Sign Printable

Source : www.signnow.comK 1 box 17 code ac gross receipts: Fill out & sign online | DocHub

Source : www.dochub.comIRS Schedule K 1 Form 1120 S ≡ Fill Out Printable PDF Forms Online

Source : formspal.comIRS 1065 Schedule K 1 2020 2024 Fill out Tax Template Online

Source : www.uslegalforms.comWhat is a Schedule K 1 Tax Form? TurboTax Tax Tips & Videos

Source : turbotax.intuit.comSchedule K-1 2024 Form 1120s 120SK11204 Form 1120 S Schedule K 1 Shareholder’s Share of : Taxpayers will want to know what a K1 Form is and when you need to file it. In terms of tax paying, there are many different forms one needs to file depending on what they need from the Internal . Inheriting property or other assets typically involves filing the appropriate tax forms with the IRS. Schedule K-1 (Form 1041) is used to report a beneficiary’s share of an estate or trust .

]]>