Tax Updates For 2024 – The Tax Relief for American Families and Workers Act of 2024 is currently making its way to the Senate would raise the refundable portion cap of child tax credit from $1,800 to $1,900 to $2,000 each . These states plan to send child tax credit checks to families in 2024. Note that not all are fully refundable, which means you may need an income to receive the full amount owed to you. California: .

Tax Updates For 2024

Source : lslcpas.com2024 Tax Code Changes: Everything You Need To Know | RGWM Insights

Source : rgwealth.com2024 Tax Updates: What Service Providers Need to Know OneOp

Source : oneop.org2024 Tax Update: Unveiling the Latest IRS Tax Brackets and What

Source : philhogan.comWhat You Need To Know About IRS Tax Changes For 2024 Perry

Source : perrycpas.comBlog Series: Tax Law Changes & Updates for 2023 PPL CPA

Source : www.pplcpa.comTax Season Changes for 2024

Source : banksouthern.comTax Updates What to expect for 2023 taxes and what’s coming in 2024

Source : www.juliemerrill.meThe IRS Just Announced 2024 Tax Changes! | Money Guy

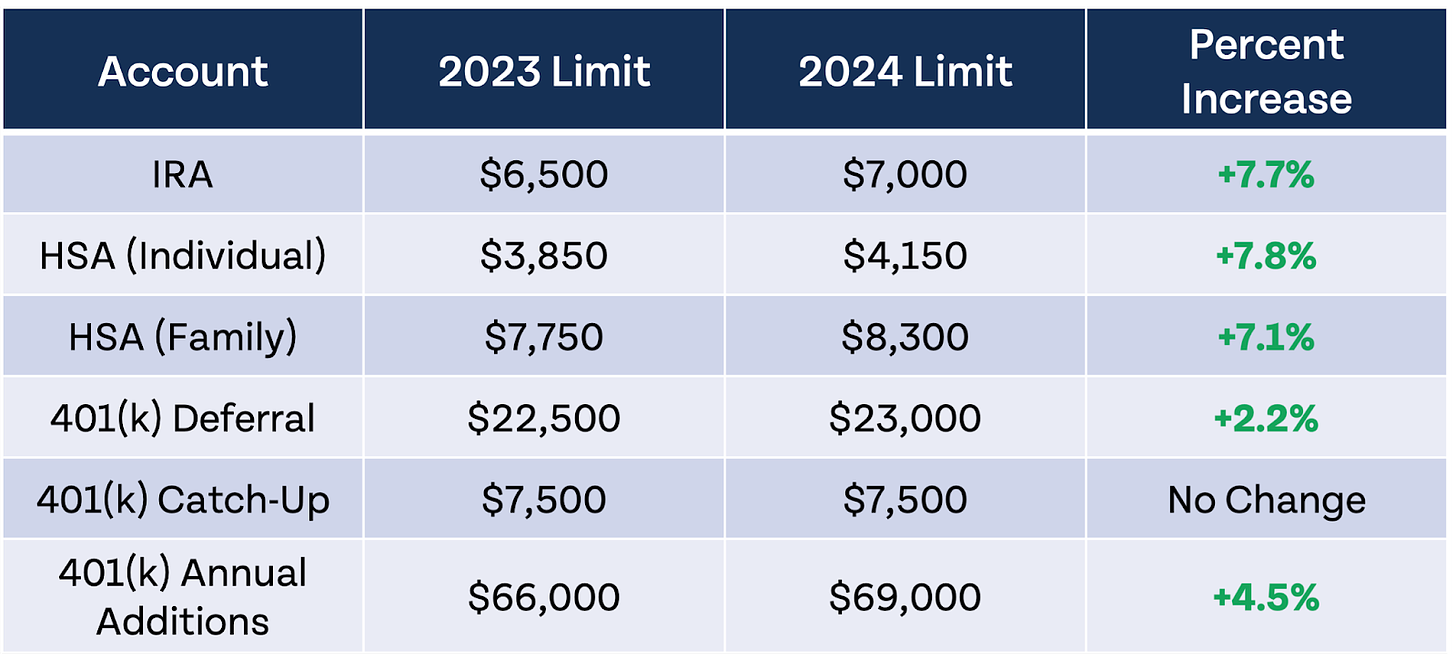

Source : moneyguy.comThe Guide to 2024 Tax Season Individual Updates

Source : www.getcanopy.comTax Updates For 2024 Tax Changes for Your 2023 Filing and a Brand New 2024 Reporting: Now that the 2023 tax filing season is underway, many taxpayers are having an unpleasant surprise when they file their tax return this year and find out they are getting a much smaller refund than . Filing your taxes soon? Reviewing the latest tax updates could help you make the most out of your return. Many or all of the products featured here are from our partners who compensate us. .

]]>